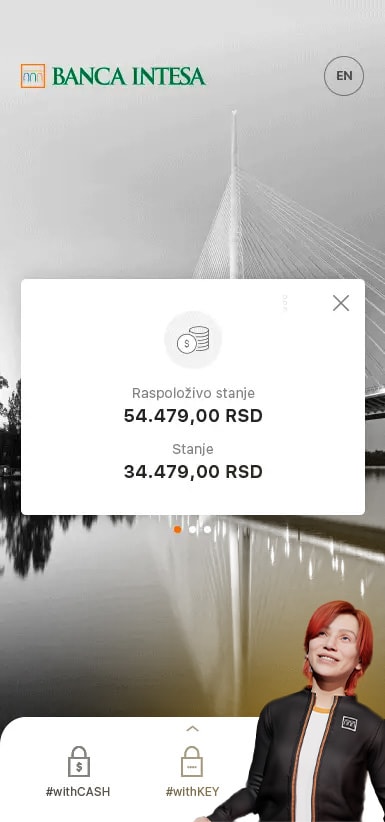

One app on all devices

Manage your finances simply and safely, via mobile phone and computer, without going to the bank. With the Banca Intesa Mobi application, perform banking services and use numerous innovative functionalities, even faster and more conveniently.

Payment cards in the Intesa Mobi application

Delivery and activation of payment cards

Save time and activate your payment card without waiting in a branch

Forgot your PIN?

No problem. It's at your fingertips.

- From the drop-down menu, select the Card / My Cards option and click the button in the lower right corner of the Other Actions screen

- Select Show PIN, enter your app login code and your PIN code will be displayed on the screen

Shopping online?

For safer payment, use a VIRTUAL CARD, which you create yourself.

HOW?

- Select the Tabs option, then New Virtual Tab

- Select the card for which you want to create a virtual version and set the desired amount

- Mark whether you want to use it once or repeatedly, and after clicking the Continue button, check the entered data and your virtual card is created

Important: The amount you define for consumption on the virtual card cannot exceed 360,000 dinars.

You need to remember the CVV code (three-digit number), because this information is not saved within the application for security reasons.

Google pay

Add your Banca Intesa card to Google Wallet and pay easily and securely via mobile.

Discover why paying with Google Pay is easy and secure:

- There is no possibility of double debiting your account, even if you touch your mobile to the POS device twice

- To be able to add a payment card to Google Pay and pay in stores, you need to set a phone screen lock

- If you turn off your phone screen lock, Google Pay will remove your virtual account number from your device for security reasons

- Google Pay does not store card information on the phone; if the phone happens to be lost or stolen, they won't be able to access the data, even if they unlock the device

Investment funds

Invest in your future.

Learn more about investment funds and find the one that suits your needs, within the Intesa Mobi application. In the section Funds / My portfolio, you will find information about yield, value and number of investment units.

At any time, through the Intesa Mobi application, you can buy or redeem investment units, without coming to the Bank.

Realize the allowed account overdraft, as well as an online cash loan of up to 1,200,000 dinars, without coming to a branch.

For an online cash loan in the amount of more than RSD 600,000, up to a maximum of RSD 1,200,000, the documentation is signed with a qualified electronic signature (Consent ID), which you can activate within the Intesa Mobi application.

Secure your credit

By contracting a loan repayment insurance policy, you protect yourself and the financial stability of your loved ones. Now you can secure your loan even faster and easier through the process of submitting an online loan application through your mobile and electronic banking applications. Learn more about our loan default insurance offers HERE.

See the product catalog

In the Product Catalog, familiarize yourself with the Bank's current offer of various products and services. According to your needs, you can apply for:

- Online cash loan

- Account overdraft allowed

If you wish, you also have the opportunity to familiarize yourself with the conditions of other products and services of the Bank:

- Cards

- Savings

- Pament account

The course of realization of credit products consists of several simple steps.

- By clicking on the SEE OFFER button, you will be shown credit products for which you can apply.

- By selecting the product that suits your needs and clicking the SEE DETAILS button, you will be shown its basic features: amount, repayment period and interest rate.

- If you are offered an answer by clicking on SUBMIT REQUEST NOW, you start the process of realizing a cash loan.

You can see the entire application process for credit products HERE.